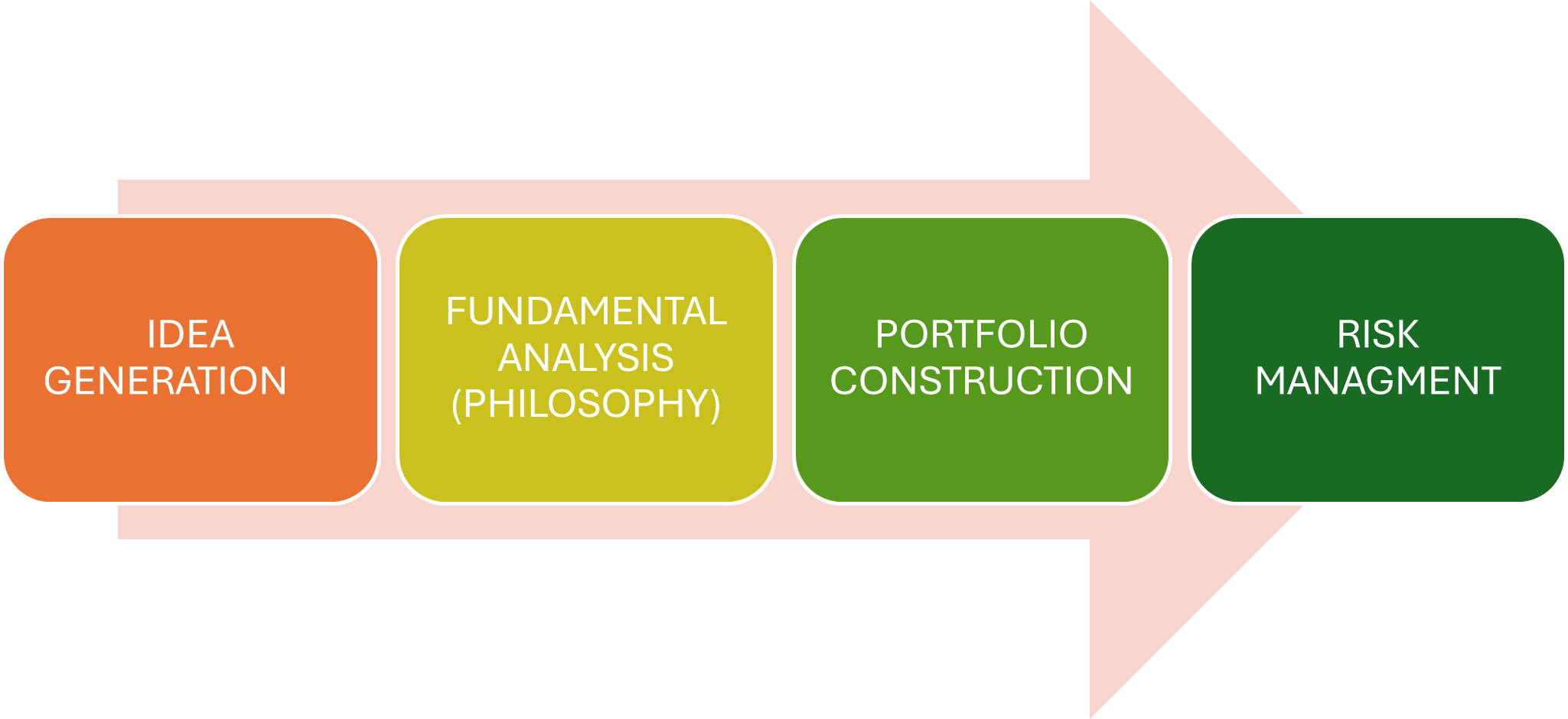

Our investment process is designed to be disciplined, transparent, and repeatable. It is guided by the following principles:

Before investing, we evaluate businesses based on three core factors:

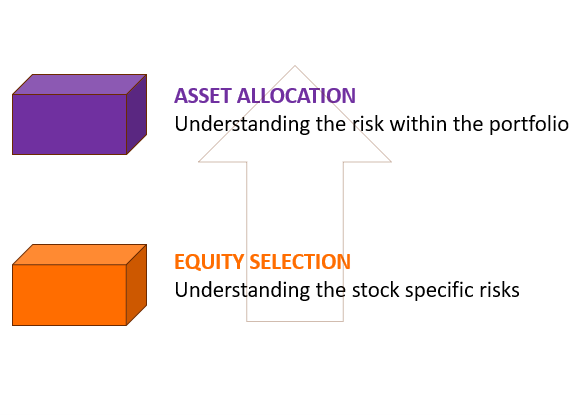

Our portfolio construction is driven by facts, not opinions. We integrate bottom-up research with valuation discipline and macroeconomic scenario analysis to reduce risk and enhance long-term returns.

Risk management is a continuous process. Through diversification and disciplined portfolio construction, we aim to generate resilient performance across varying market conditions.